Many people think student loans are a problem for American students in 2017.

The total amount of debt is enormous, a good number of students carry serious loans, some leave school owing money yet lacking academic credentials, etc. I and others have been enumerating these problems for a while.

Could the negative impact of student loan debt reach even further?

Might the sheer size of $1.4 trillion in debt damage the broader American economy?

The New York Federal Reserve Bank just released a studying arguing that this is the case. Specifically, a significant number of students now carry enough debt to prevent them from buying homes. This in turn cramps the housing market and weakens overall national economic growth.

Zachary Bleemer, Meta Brown, Donghoon Lee, Katherine Strair, and Wilbert van der Klaauw (pdf) found that millennials loaded up with increasing debt were less likely to buy houses after leaving college.

the tuition hike and student debt increase… can explain between 11 and 35 percent of the observed approximate eight percentage-point decline in homeownership for 28-to-30-year-olds over 2007-15…

Why and how does this happen? Simply put, debt holders (former students) will be more anxious about adding still more debt. They might also have a harder time with banks. “[Y]oung consumers who manage increased college costs by borrowing might be expected to experience decreased mortgage access.”

As a result,

We find that homeownership among 28-year-olds declined steadily from 24.4 percent in 2007 to 16.0 percent in 2015, an approximate 0.94% annual decline. We see a similar decline for homeownership at age 29 (0.91% annual) and a slightly smaller decline at age 30 (0.

buy valif online buy valif no prescription generic74 annual rate).

In chilly econ-speak:

The costs to the local economy of a shift of the cost of human capital investment onto the current young cohort are estimated to appear… in a more muted participation of the young cohort in the local housing market in years to come.

So that generation is harmed, if we consider home ownership to be a good thing, as many do. Graduates are more likely to live with their parents, and to have weaker savings for their eventual retirement. The broader economy grows more slowly as a result. Student debt: what can’t it do?

Some interesting extra details:

- The researchers’ dataset underrepresents student loan holding. Their population is below the median circa $30K figure: “The mean student debt per capita among 24-year-olds in our sample is $6,715 with a mean of $3,902 in 2003 rising to a mean of $9,603 in 2011.”

- Their modeling of costs does not include room and board (14). As Sara Goldrick-Rab points out, this can be a crucial cost.

- A key take-away: students keep going to college, despite rising prices (20).

Looking ahead, most signs point to student debt continuing to increase. What does this suggest for the future of higher education?

Opposition to this knock-on effect of debt could play out in several ways. Perhaps we’ll see major economic players (the real estate sector, at least) asking for debt reduction in some form: pressuring colleges to lower costs, lobbying states for more financial support. This NY Fed analysis could be additional fodder for public universities lobbying state governments for increasing support – i.e., “please boost state system funding or the economy will suffer.”

Reaction against the expanded student debt issue could also take the form of cultural criticism. Some may criticize millennials for harming economic growth, adding yet another way for millennial-bashing to proceed. In a different way, dismay at the economic impact of student debt could fuel a cultural shift away from the college-for-everyone mindset (blog post coming up on that).

Alternatively, we could see acceptance of student debt appear as growing cultural support for less home ownership: a celebration of rental living, especially in cities, or approval of an expanded family unit. The latter might tie into other cultural currents, namely how America processes its aging demographics. Perhaps we’ll see three-generation households valued once more, either by conservatives (a return to strong, traditional families), progressives (increased care for the elderly), or both, in a rare sign of political bipartisanship.

I’d really like to know what the financial sector’s leaders think about this. Increased debt is usually good for their business, in the form of fees. Are they seeing a generation switching from housing to college debt? Is this their preferred business model, or will they lobby for changes?

Reblogged this on As the Adjunctiverse Turns and commented:

Adjuncts, consider the long term effects of our own student debt. Many of us carry a substantial student debt load from grad school. Our work status makes it even harder to qualify for PSLF. It’s not just the debt making adjunct futures grim. However statistically insignificant when compared to the general student population, we are. as a group, aging out. Seniors are a vulnerable population and among the most affected by changes in insurance, Medicare, Medicaid, access to affordable housing, USDA and other programs in the fraying social safety net.

http://www.chronicle.com/article/In-Higher-Ed-Adjuncts-May/239999

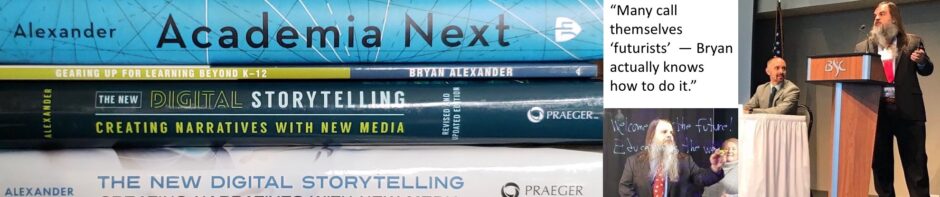

Pingback: On the solstice, dark thoughts for 2018 | Bryan Alexander